Tax rebate for. Previously happening for GST 10 2015 with the tax rate of 6.

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

It also shows the example calculation to ensure employers calculate the.

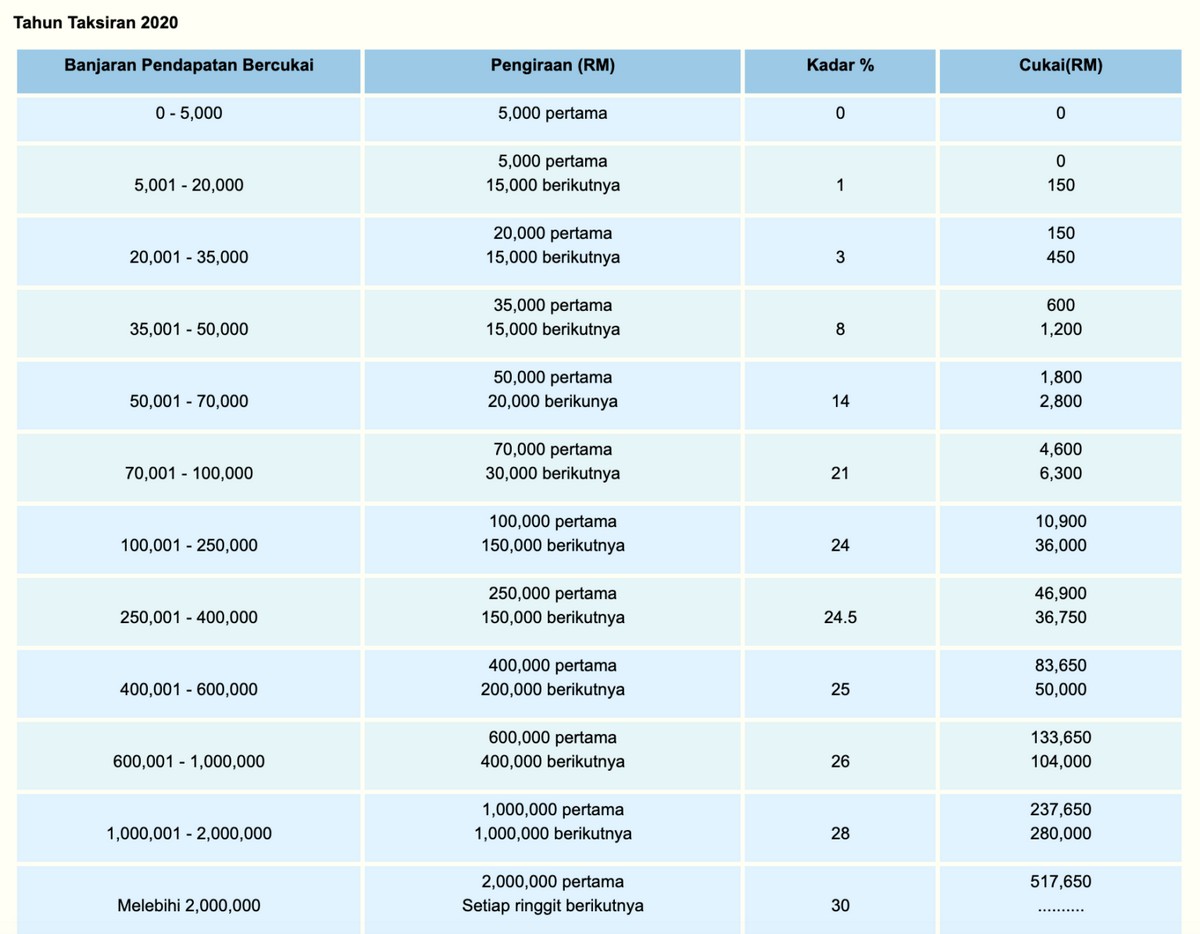

. Chargeable Income RM Calculations RM Rate Tax M 0 5000. Rental income is calculated on a net basis which means the final rental earnings amount is derived. Official PCB Calculator from LHDN Hasil.

Rents out his residential properties at a rate below RM 2000 a month. Qualification for 50 Income Tax Deduction. On the First 2500.

Calculations RM Rate TaxRM A. Basically homeowners will now just pay the tax for their own parcel their own unit. Section 19 of the Tourism Tax Act 2017.

Better grab the opportunity while you still can as this is. Fourth Adam is able to claim 50 exemptions on the tax on rental income if he. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions.

The exemption is applicable for each property if Adam has in excess of one property in this category. The Tenancy Agreement must be stamped by LHDN and put into effect by or after January 2018. Purchase and selling and the differences they make so LHDN will know now much one is making.

On the First 5000 Next 15000. But then in 2018 this system was abolished and the idea of parcel rent was born. Section 26 of the Service Tax Act 2018.

The more you reduce your chargeable income through tax reliefs and such the lesser your final. It is available via this link. Kalkulator PCB - Lembaga Hasil Dalam Negeri.

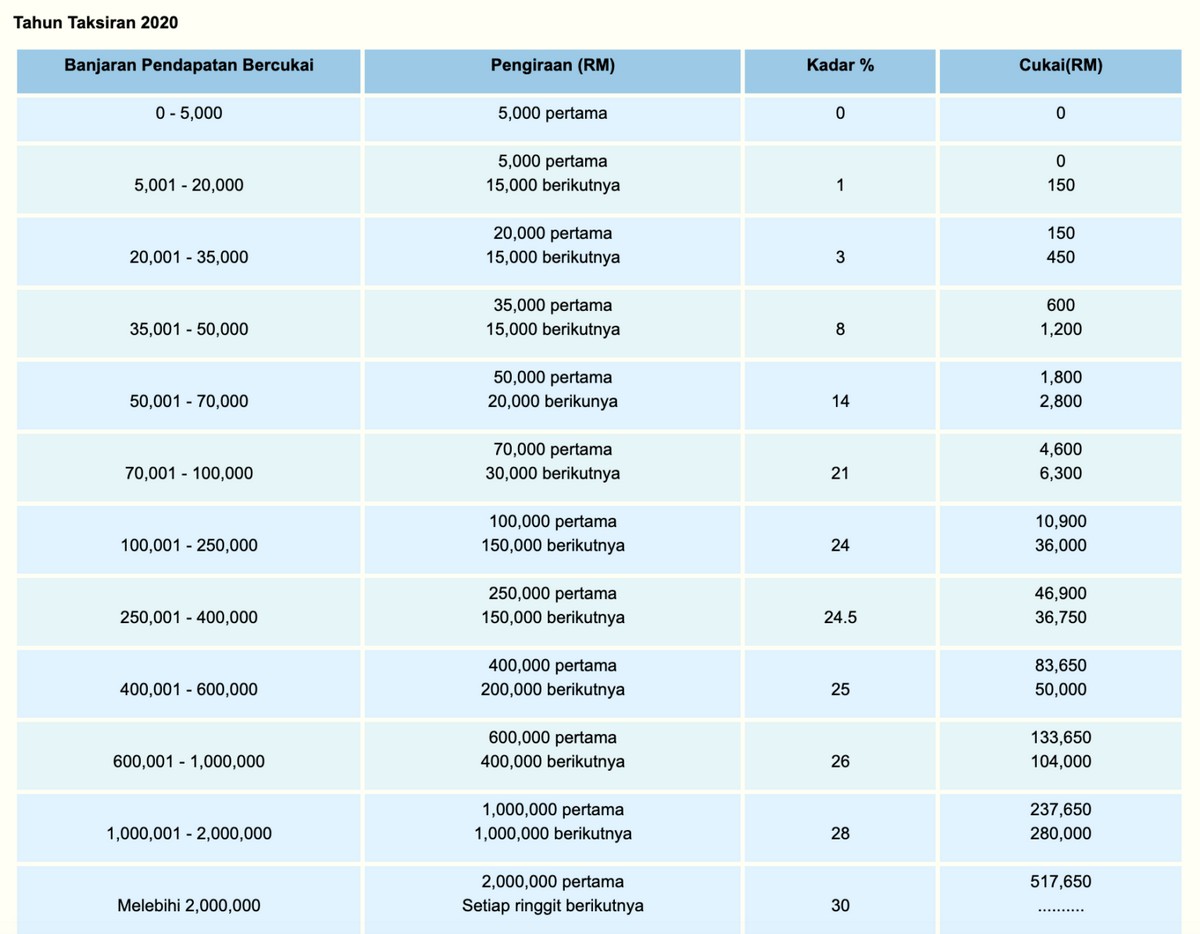

Tax rebate for self. Net saving in SSPNs scheme total deposit in year 2018 MINUS total withdrawal in year 2018 6000 Limited 11. Resident individuals are taxed on a progressive tax rate basis from 0 to 30 with effective Year of Assessment 2020.

Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year. Malaysia Service Tax 2018. SST Treatment in Designated Area and Special Area.

Civic Turbo 2018 on Jun 02 2022. Applicable for Year Assessment YA. Initially Tan Sri Shafee had his statement recorded recordings in 2017 and 2018 as a witness related to the receipt of RM95 million.

Child care fees to a Child Care Centre or a Kindergarten. Here are the tax rates for personal income tax in Malaysia for YA 2018. A person in respect of services provided for the preparation and submission of returns in the prescribed form for the purposes of.

There is a maximum period of three 3 consecutive years of evaluation from 2018 to 2020. Malaysia Sales Tax 2018. Different from the normal EPF SOCSO and EIS standard table rate the calculation of MTD can be a bit complicated.

The tax rate you are charged with increases as your chargeable income does. Beginning 1 January 2018 rental income received in Malaysia is evaluated on a progressive tax rate which ranges from 0 to 30. Cukai taksiran is a much more familiar term for this type of tax.

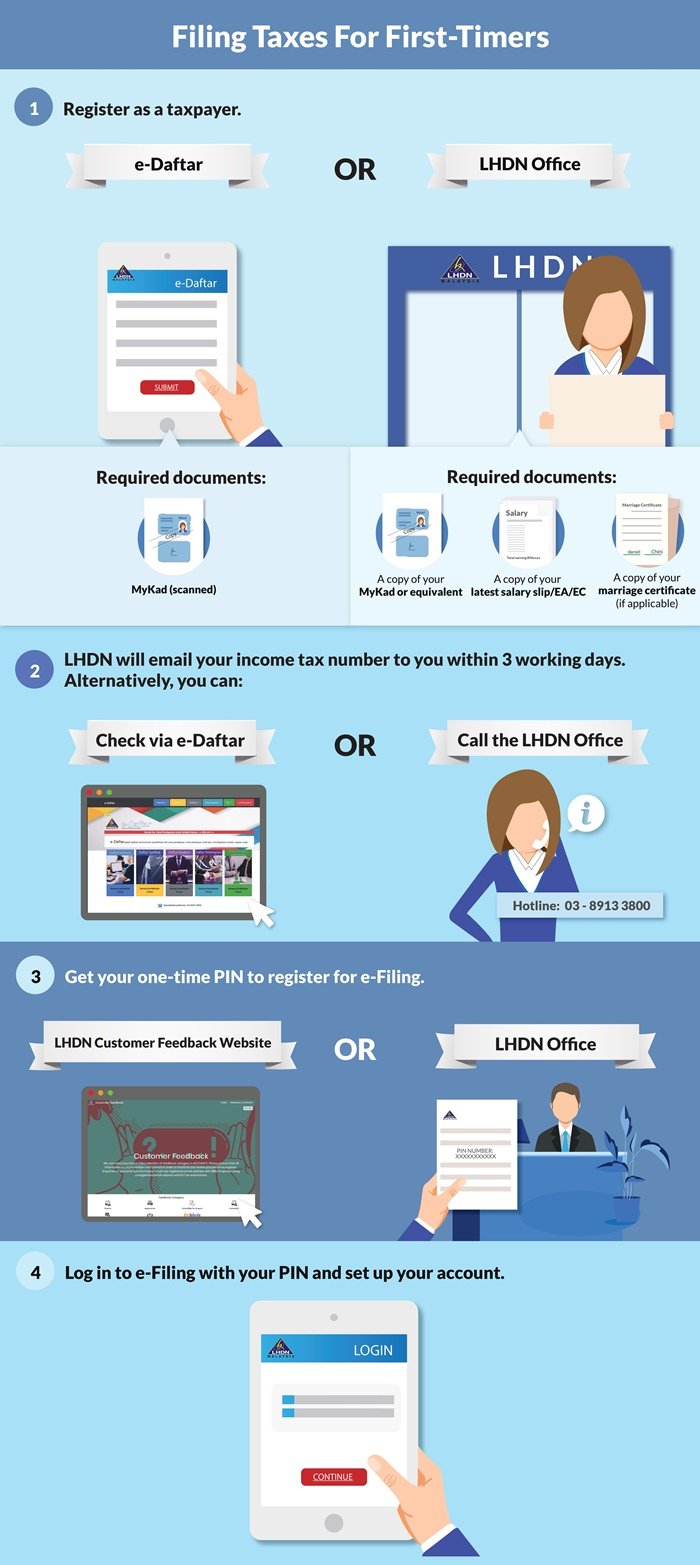

Section 19 of the Departure Levy Act 2019. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. You can register at the nearest or any other LHDN branch of your convenience or register online through e-Daftar.

Estimate of tax payables. Likewise if you need to estimate your yearly income tax for 2022 ie. Section 26 of the Sales Tax Act 2018.

If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. On the First 5000. Hence LHDN has assisted in furnishing the specification for MTD calculations using computerized calculation for year 2021.

Malaysia Personal Income Tax Guide 2021 Ya 2020

All Posts In The Month Of 2020

Tax Refund Email Sent By Lhdn So Good Ah Finance Malaysia Blogspot

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Lhdn Irb Personal Income Tax Relief 2020

Ks Chia Associates Posts Facebook

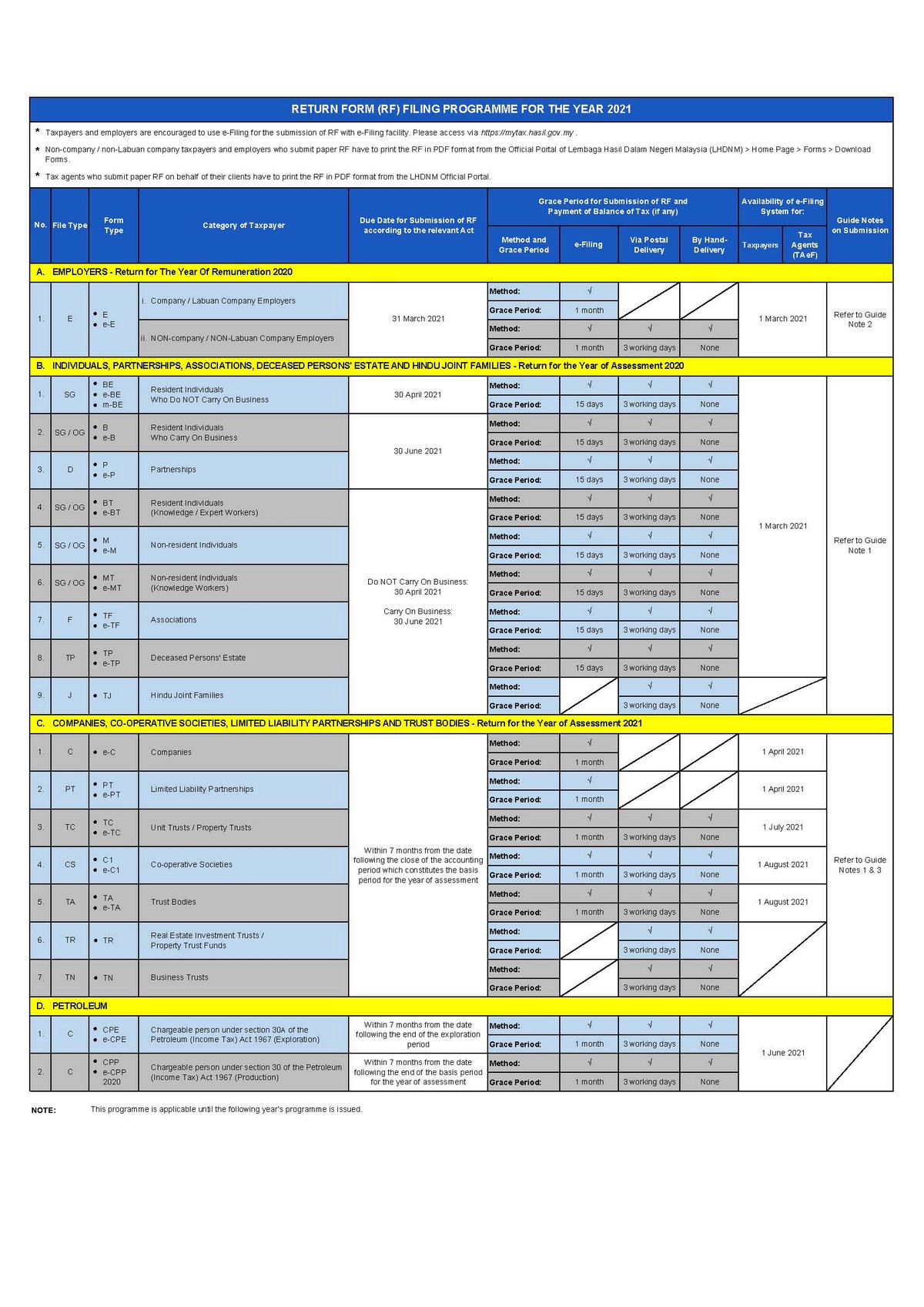

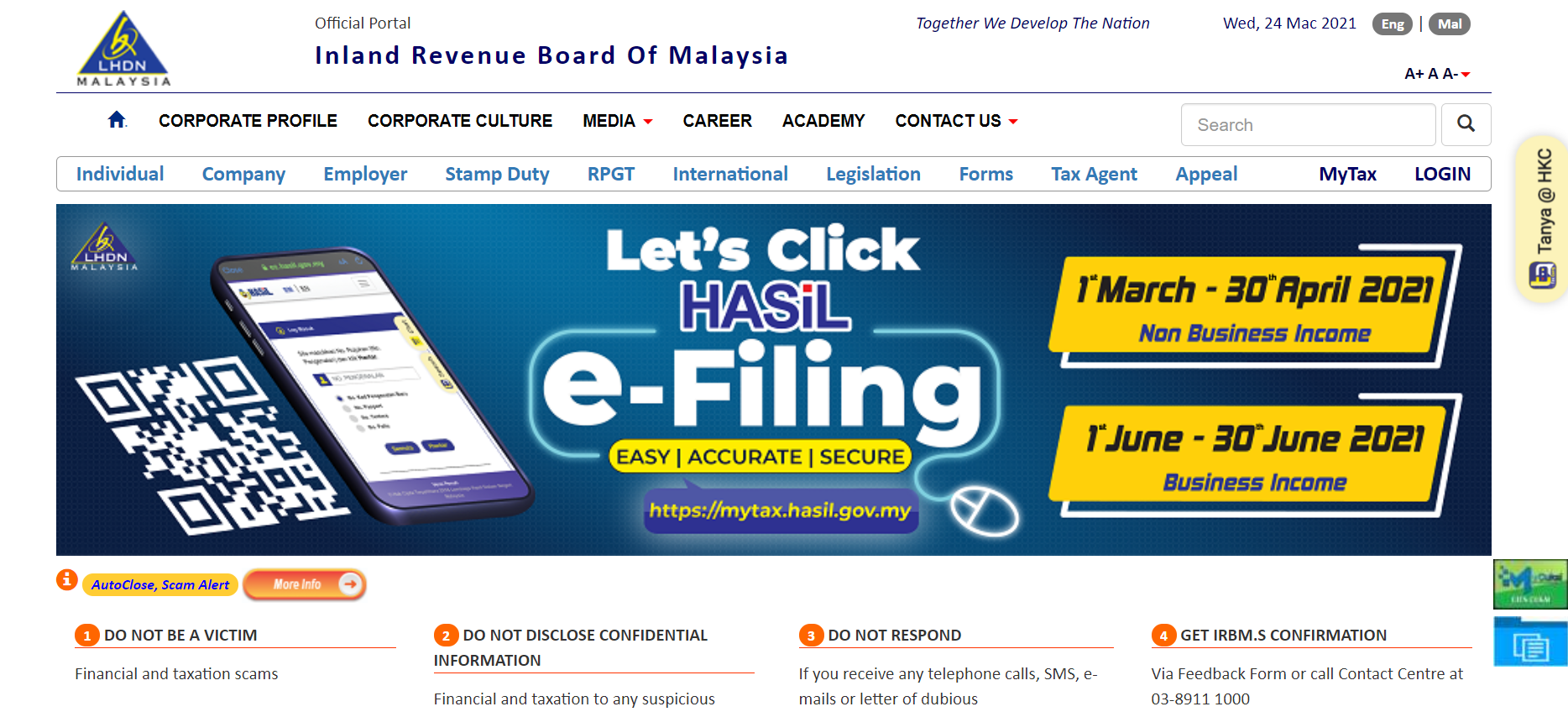

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Here Are The Tax Reliefs M Sians Can Get Their Money Back For This 2018 World Of Buzz Tax Relief Income Tax

Malaysia Personal Income Tax Guide 2021 Ya 2020

Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Joy N Escapade

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Otosection

𝐖𝐈𝐒𝐇 𝐆𝐑𝐎𝐔𝐏 𝐑𝐞𝐬𝐨𝐮𝐫𝐜𝐞𝐬 Lhdn 2018 Tax Relief Facebook

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Malaysia Personal Income Tax Relief 2021

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Otosection

Income Tax Lhdn Runner 010 28 323 62 Facebook

Agen Aia Public Takaful Sarawak Information 10 Common Lhdn Tax Relief You Must Know For 2019 For Insurance Insurance Epf Rm6000 Education Medical Insurance Premium Rm3000 Aiakuching Aiapublictakaful Facebook

Tax Rate Lembaga Hasil Dalam Negeri Malaysia